Unions react to the Bank of England’s interest rate hike

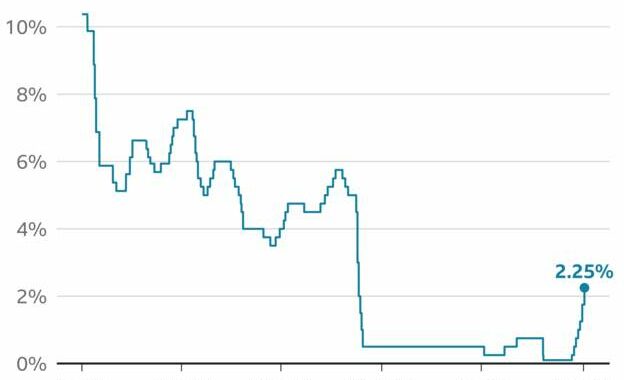

The Bank of England has raised interest rates to their highest level for 13 years, with a 0.25% increase to 1%.

On Thursday, the Bank of England raised interest rates to their highest level for 13 years, with a 0.25% increase to 1%.

It’s the fourth hike since the base rate stood at 0.1% at the beginning of December.

The Monetary Policy Committee voted to raise #BankRate to 1%. Find out more in our #MonetaryPolicyReport: https://t.co/h3ewfvAPYp pic.twitter.com/I5q7mliWza

— Bank of England (@bankofengland) May 5, 2022

In the middle of a cost of living crisis, the Bank of England has warned that the crisis could plunge the economy into recession this year, as it increased interest rates in an affort to tackle soaring inflation rates, that are expected to rise above 10% in the coming months.

With double-digit inflation not seen since 1982, households face a monumental crisis with wages struggling to keep up with the rising inflation.

Unions have reacted with dismay at the Bank of England interest rate increase.

Kate Bell, TUC head of economics, said:

“This is the wrong time for a rate rise. The economy is already slowing down and the rise will further harm growth. And it won’t have much impact on supply side problems like rising energy costs.

The main actions needed are from government, rather than the Bank. We need an emergency budget to help families with the cost of living crisis. And it should include a windfall tax on excess profits from oil and gas, with the revenue used to help households with their bills and energy efficiency.”

Sharon Graham, leader of Unite the union, said:

“Workers are getting hammered from all sides and this rise will add to the pain. Four out of ten UK families are already struggling to pay energy bills and are spending less on food.

This will pile more financial pressure on ordinary families – mortgages, rents and price rises – all part of the big business drive to make workers pay for the pandemic. Unite continues to resist that as our wins on pay deals in the last six months shows.”

Gary Smith, GMB General Secretary, said:

“The Bank of England’s announcement on interest rates is all pain and no gain and will only help push the UK closer to recession.

GMB warned this would happen.

This doubling-down on further rate rises will increase costs on homeowners, hit jobs and stifle business investment.

“Once again, the working people of this country will pay the price.”