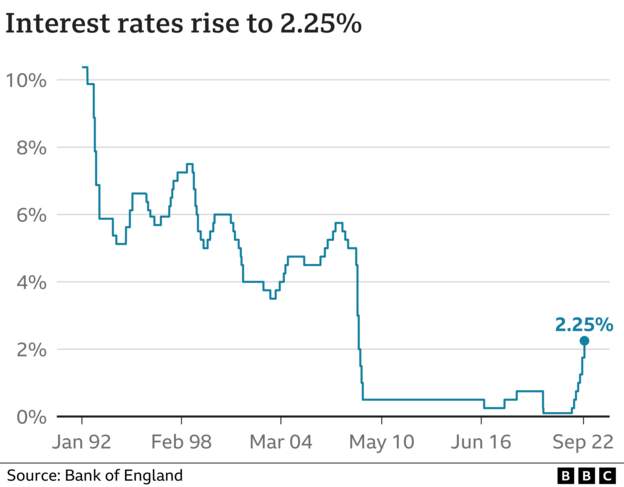

Interest rates rise for seventh time in a row – to 2.25%

The Bank of England's Monetary Policy Committee split 5-4 on rate rise

UK interest rates have increased to 2.25% – the seventh time in a row the Bank of England has raised rates.

The rate has been lifted by half a percentage point from 1.75% and takes borrowing costs to their highest levels since 2008. Interest rates have been rising since last December as inflation has risen to its highest level in four decades.

The Bank of England’s Monetary Policy Committee voted by five to four to hike the rate by half a percentage point. Analysts had predicted the rate could have risen as much as three quarters of a percentage point. It takes the interest rate to 2.25% – the highest level since November 2008, when the banking system faced collapse. Three of the dissenting members preferred to increase the bank rate by three-quarters of a percentage point – to 2.5% – while the other wished to increase it by a quarter of a percentage point.

It is the seventh time in a row that the Bank of England has raised rates. Inflation is currently at its highest rate for nearly 40 years. At 9.9%, it remains five times the Bank of England’s target of 2%. Inflation is also widely predicted to head higher in October despite government intervention to limit the impact of gas and electricity costs on households.

As well as increasing interest rates, the Bank of England also forecast that the UK economy is already in recession.

It said that it expected gross domestic product (GDP) to have shrunk by 0.1% between July and September. A recession is defined as two consecutive quarters – or two three-month periods – of shrinking GDP.

UK output shrank by 0.1% in the second quarter of the year. The Bank of England had previously forecast that GDP would grow between July and September before beginning to slow down in the final three months of the year. But it now expects the economy has contracted sooner.

Commentating on the latest increase in interest rates made today, Unite General Secretary Sharon Graham said:

“The latest increase in interest rates sends another cold chill across the UK. Household budgets are already stretched beyond reason by surging prices. There has to be some respite for workers but the Bank of England is piling on the pain.

It is remains remarkable that, in the teeth of all the evidence, the Bank is refusing to countenance that the record-breaking excessive profits have to be tackled to address inflation. Instead, it chooses to place this hideous burden on those who can ill-afford yet more demands on already stretched wages.

The Bank has a duty to build an economy that works for all. It should be pointing to the £15 billion in excess profits made by the energy sector alone and saying that money needs to be better used providing assistance to those struggling, not providing more comfort to the super-rich.

Workers need immediate assistance to deal with all aspects of the cost of living crisis, the limited help being offered by the government has been too little and too late.”

The General Federation of Trade Unions (GFTU) has just this week published a pamphlet looking at the true causes of inflation – weak production and high profits, which can be downloaded here.