Alice Martin

Alice advises shareholders on labour rights for Pensions & Investment Research Consultants Ltd (PIRC), Europe’s largest independent corporate governance research... Read more »

The disastrous Deliveroo IPO shows it is possible for investors to take workers' rights into account, but there is still a long way to go.

In March, the shambolic initial public offering (IPO) of gig economy giant, Deliveroo, saw a string of global asset managers, representing over £2.5 trillion in combined assets, boycott the listing. Alongside concerns about Deliveroo’s business prospects and governance, they highlighted the company’s employment model as a key reason for withholding capital. The share price plummeted on the first day of trading, earning Deliveroo the title among City analysts as being the worst IPO in the history of the London Stock Exchange.

The asset managers involved (including Aviva, Aberdeen Standard, BMO Global and Legal & General) are major suppliers of capital to markets globally and shareholders in most major listed companies. Their rejection of an investment on labour rights grounds is not business as usual. Whilst there have been well-organised efforts among institutional investors to align portfolios with carbon reduction targets in recent years, social standards, particularly in relation to labour rights, have been a blind spot.

In research out this week we’ve reviewed a sample of foundation sector investment policies (an often overlooked subset of institutional investors) to see what social, environmental and governance (ESG) standards currently guide their shareholdings and the asset managers they employ. We found that whilst over two-thirds of their investment policies referenced environmental standards, less than a quarter mention labour rights.

As mission-driven organisations, foundation sector investors can be a bell-weather for institutional investment trends more broadly. Despite the current limitations in their policies, which are consistent with the responsible investment sector at large, there are signs that foundations are upping the ante on understanding the social implications of their portfolios and exerting influence on this.

Whilst there have been well-organised efforts among institutional investors to align portfolios with carbon reduction targets in recent years, social standards, particularly in relation to labour rights, have been a blind spot.

Earlier this year, Schroders quietly removed Amazon from an ESG-friendly responsible investment fund on the grounds that it does not meet their criteria of being a socially sustainable company. This was encouraged by three UK foundations: Friends Provident Foundation, Joffe Trust and Blagrave Trust, which combined their assets and made the case to their manager, Cazenove Capital (an arm of Schroders), that a company like Amazon with such a poor track record on labour rights has no place in the fund. A small step, perhaps, but it shows that chains of activity can be sparked within capital markets, and specifically, this can happen in support of progress on labour rights.

There is a clear opportunity for foundation sector investors to do more in this space. Whilst the sector makes around $3 billion’s worth of charitable grants each year, this is dwarfed by their collective investable asset base of around £67bn. Deploying and strategically investing this in ways that supports progress on labour rights and other social factors could have real impact.

In the report, we explore some barriers to doing so – in particular, the asset manager industry, which is dominated by a handful of large firms who, to a great extent, set the tone for what constitutes responsible investing.

There are signs that foundations are upping the ante on understanding the social implications of their portfolios and exerting influence on this.

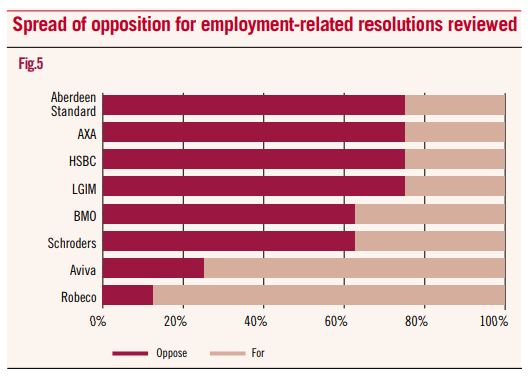

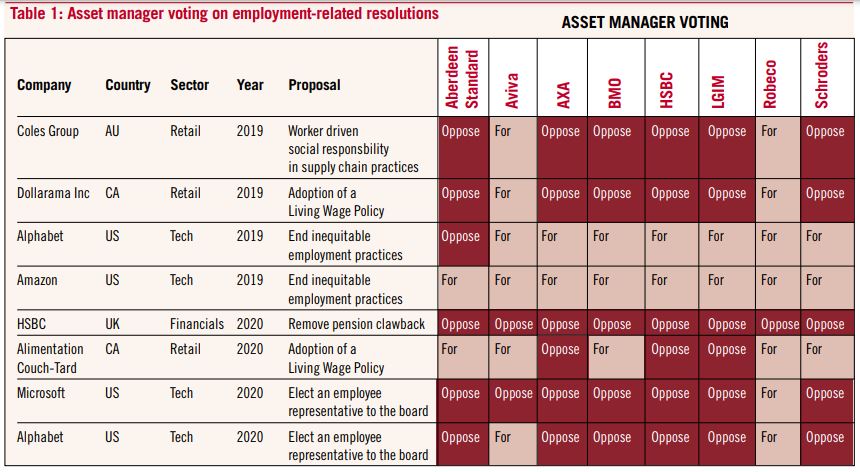

We found that despite the examples shared above, perhaps unsurprisingly, asset managers are generally not acting as an ally on labour rights. We analysed voting data of a handful of managers on pro-labour rights resolutions filed in US, UK, Canadian and Australian listed companies – and as the chart and table below shows, there is a lot of opposition.

With the exception of the 2019 resolution at Amazon to end inequitable employment practices (which was supported by all eight managers in the study), other seemingly innocuous resolutions – such as one in support of the Living Wage filed at Canadian retailer Dollarama – were voted down by the majority of managers. The same managers voted against a resolution at Australian supermarket Coles for the increased involvement of workforces in supply chain auditing processes.

Is there an opportunity to challenge this status quo? Efforts on the climate change agenda over the last decade are instructive. Pressure applied to asset managers has meant that today even the very largest managers have begun to vote more robustly on climate, and companies have in turn felt obliged to respond. Any moves of this kind are always bound up with financial and reputational interests and risks – and these can be used by campaigners as levers to drive more change.

We carried out the research with the support and guidance of the Alex Ferry Foundation, a young foundation with labour movement origins. We hope it sparks conversations about the tensions and opportunities there are in seeking to use investment practices in support of a worker’s rights agenda.

Alice advises shareholders on labour rights for Pensions & Investment Research Consultants Ltd (PIRC), Europe’s largest independent corporate governance research... Read more »

Why we need workers and their unions to lead the climate debate