Rail bosses award themselves ‘eye watering’ annual pay rises – RMT research

The report also reveals that the since the pandemic the private train operators stand to make taxpayer profits of £412 million by September this year.

Via the RMT:

Fat cat rail bosses award themselves eye watering annual pay hikes while lecturing rail workers on need for pay restraint and reform.

On the day that rail workers take strike action in defence of their jobs, pay and conditions and railway services new RMT research (below) has revealed that bosses at seven rail companies have awarded themselves annual pay rises of between 15- 275% whilst most rail workers have been subject to a pay freeze.

For instance, at First Group, whose train companies include failing Avanti West Coast and Transpennine Express, the remuneration of the Chief Financial Officer and CEO increased by an eyewatering 275% and 168% in one year.

To put that into context, the jump in remuneration of the then First Group CEO Matthew Gregory was more than 800 times higher than the pay award offered to rail workers for last year (based on average salary of £29,000 of a rail worker involved in today’s action).

The report also reveals that the since the pandemic the private train operators stand to make taxpayer profits of £412 million by September this year, all funded by the taxpayer. RMT estimates that the train companies’ average annual profits since the pandemic, around £118m, are nearly double what the current pay offer would cost for one year (£60m)

General Secretary Mick Lynch said:

“On the one hand Ministers tell workers they must tighten their belts and on the other they are using taxpayer’s money to fund eyewatering pay rises and profits for the railway fat cats. It is this blatant the unfairness that will only reinforce our members determination to get a better deal.”

RMT members at the Train Operating Companies have been engaged in a prolonged dispute over pay, jobs and conditions. Members have been subjected to multi-year pay freezes and have only been offered a pay deal below inflation, which was dependent on accepting a raft of attacks on jobs and conditions. Yet, RMT analysis reveals that it is quite a different picture for many of the top directors at the train companies and their owning groups, many of whom have seen their remuneration soar in the last year.

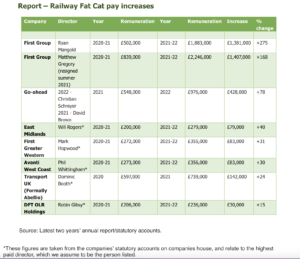

The table above shows that at various train operators or parent companies, top directors’ remuneration has increased substantially in the last year alone, at the same time as frontline workers continued to be subjected to pay freezes.

For instance, at First Group, whose train companies include failing Avanti West Coast and Transpennine Express, the remuneration of the Chief Financial Officer and CEO increased by an eyewatering 275% and 168% in one year.

To put that into context, the jump in remuneration of the then First Group CEO Matthew Gregory was more than 800 times higher than the pay award offered to rail workers for last year (based on an average salary of £29,000 of a rail worker involved in today’s action).

The director remuneration listed in the table below has all increased above RPI inflation.

It is quite clear that there is plenty of money in the rail industry to fund pay increases, but that a decision has been made to keep rewarding the Fat Cat bosses at the expense of the frontline workers who are continuing to face a cost-of-living crisis.

At the same time, the train companies continue to drain profits out of the railway…

Under their contracts with the DfT. The private train operators collect management fees of around 1.5% of their cost base in profits which they can pass on to their shareholders.

Statutory accounts show that last year, Train Operating Companies paid out almost £80 million in dividends to their owning groups in the last year – and not all of them have filed accounts yet.

Over the course of the pandemic, train operating companies made £310 million in profits from these management fees. By September this year, that is likely to be in excess of £412 million, averaging around £118m a year.

RMT estimates that the current pay offer for the train operating companies would cost around £60 million for last year (5% increase or £1750, whichever is higher).

According to their latest accounts, 3 out of 4 of FirstGroup’s rail companies paid dividends from their DfT contracts last year, totalling £59.4 million. Over the last two years, while they were on emergency contracts from the pandemic, they paid out £90 million in dividends to FirstGroup plc. The group has paid out an interim dividend of £6.7 million to its City shareholders in the first half year of FY 2023 and indicates it expects to pay out around £20 million over the year.

Full story on the RMT website here.