Lord John Hendy QC briefs on the gaps in the Coronavirus Job Retention Scheme

IER Chair, Lord John Hendy QC, warns that millions of workers risk destitution due to gaps in the Job Retention Scheme.

The IER today publishes a new briefing from Lord John Hendy QC, originally provided for Shadow Secretary for Employment Rights, Rachel Maskell, which details the outstanding issues in the Coronavirus Job Retention Scheme.

He warns that government reassurance that agency workers and those on zero-hours contracts will be covered by the Scheme may be misguided, as there remains a financial incentive for employers to cut – rather than furlough – casualised labour.

Other vulnerable groups include those receiving Statutory Sick Pay under the new rules introduced to cope with the crisis. While those eligible for the benefit can normally claim it for six months, this has been significantly reduced to just seven days for those ill with Coronavirus and 14 days for their carers. Where low-paid workers are reliant on the benefit, this poses a risk that they will return to the workplace before they have fully recovered from the disease, potentially spreading it to others.

Key points from the briefing

-

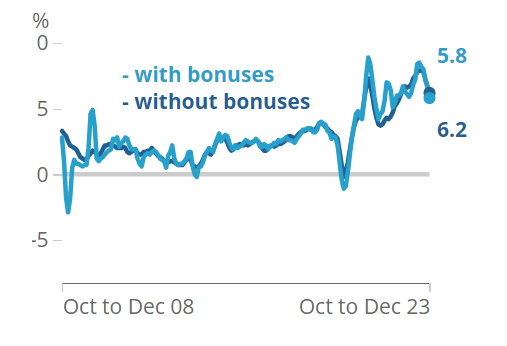

Statutory Sick Pay is less than 30% of the minimum wage

The sum of £94.25 pw is lower even than the lower earnings limit of £118 pw, which a worker must earn in order to be eligible for the benefit. It is less than 30% of the £331.36 which a 38 hour a week over-25-year-old earner would receive for a week’s work if paid the NWM/NLW (£8.72 ph from 1 April 2020). It is only 18.4% of current average weekly earnings of £512 per week (excluding bonuses).

-

Up to 9 million workers are not eligible for Statutory Sick Pay

The number of workers paid less than the lower earnings limit of £118 pw is around 2 million, while 5 million limb (b) workers are also excluded from the benefit. It is also unclear whether the almost 1 million agency workers and further 1 million people on zero-hours contracts are entitled to Statutory Sick Pay. Others who may not be able to work but cannot claim the benefit include people forced to self-isolate because they are in at-risk groups (such as those with underlying health conditions), and carers for relatives who would normally use services such as nurseries, schools and day care facilities.

-

Business closures are expected due to the lack of immediate financial support

Delays in the availability of the Job Retention Scheme, which cannot provide payments to employers until the end of April 2020, are likely to lead to significant business closures and associated job losses. Meanwhile, government action to facilitate bank loans to help keep these businesses afloat is negated by skyhigh interest rates that make borrowing unaffordable.

-

Two-thirds of households cannot survive a pause in their pay

Before the crisis, only one in three households had the savings available to cope with an emergency, and household debt averaged at 98% of household income (rising even higher for lower earners).

-

At least 500,000 lost their jobs before the Job Retention Scheme became available

Around half a million workers applied for Universal Credit before the announcement of the Job Retention Scheme, as businesses quickly folded or made dismissals. This figure has since risen to 950,000. Although employers have the opportunity to rehire workers sacked since 28 February in order to apply for the Scheme, there is little incentive for them to do so.

-

The Job Retention Scheme permits payment below the National Minimum Wage

Furloughed workers are entitled to 80% of their pay through the Job Retention Scheme, excluding commission and bonuses that many workers are significantly reliant upon. There is nothing to stop the wage workers receive during this time fall below the National Minimum Wage. Further, due to the low cap of £2,500 pcm, many workers will lose significantly more than 20% of their earnings.

-

Up to 9 million workers may not be eligible for the Job Retention Scheme

Around 5 million limb (b) workers, almost 1 million people on zero-hours contracts and around 1 million agency workers are either excluded from the scheme or unlikely to be furloughed. A significant gap exists for those forced to stay out of work to care for people who would otherwise be provided for by nurseries, schools, day care centres and other public services. While it is possible for these workers to be furloughed, it is unlikely they will be.

-

No support for reduced hours/pay

A significant number of businesses will require a skeleton staff to stay on to keep the organisation afloat, but there is no entitlement to partial furlough.

-

It is cheaper and legally ‘safer’ for employers to dismiss rather than furlough

The stated objective of the Job Retention Scheme is to maintain employment through the crisis, but with no right to furlough and – for many employers – no financial incentive to do so, many employers will find it safer to dismiss their workforce.

-

One in four self-employed people could go bust before they receive help

The Self-Employed Income Support Scheme will not pay out until June, but 25% of self-employed people do not have a high enough income to support themselves until then and 15% cannot last one month.

-

Those with two jobs could face significant income losses

Hard cut-offs to the Self-Employed Income Support Scheme mean that those who supplement a part-time job through self-employment risk losing a significant amount of their income. If a self-employed person earns less than 50% of their total income working on their own behalf they are not eligible. Similarly, a hard cut-off at an income of £50,000 a year means those who earn one penny less are eligible for the scheme but those who earn one penny more are not. Lord John Hendy QC argues that a taper would be fairer.